COST MANAGEMENT ACCOUNTANTS (CMA)

THE INSTITUTE OF COST ACCOUNTANTS OF INDIA

About CMA

The CMA course is gaining popularity among commerce students, who want to pursue a career in the area of Cost and Management accounting.

Over time we have seen that people tend to confuse between various terms like CMA, ICMAI, CWA, and ICWAI. So, to end your all confusion, Institute of Cost & Works Accountants of India (ICWAI) has changed its name into The Institute of Cost Management Accountants of India (ICMAI). Also, ICWA course has been renamed as CMA course. There is no difference between ICWAI and CMA, and they are the same. They are two different words used to describe one single thing. ICWAI stands for Institute of Cost and Work Accountant of India whereas CMA stands for Cost Management Accounting. Apart from the literal meaning, there is no difference at all.

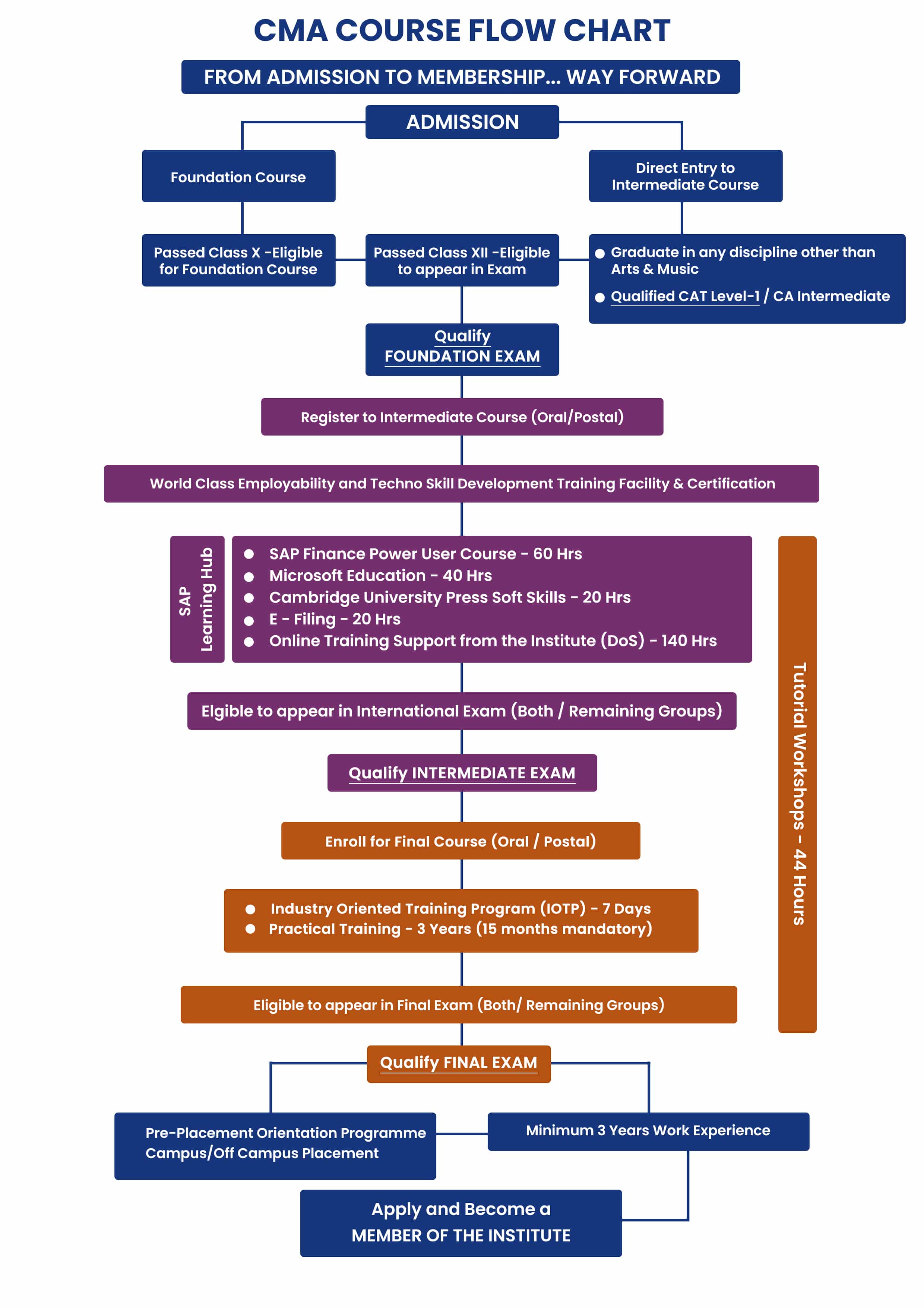

If you want to become a Cost management accountant, complete three stages of the CMA course. Students who have passed 10 +2 are eligible for the CMA Foundation exam. The Institute of Cost Accountants of India conducts CMA Foundation exam two times in a year in the months of June and December. If you have passed the CMA Foundation exam, then you are eligible for CMA Inter. If you have any graduate degree, you are exempted from ICMAI Foundation exams. You can directly enter into CMA Inter.

Opportunities: Career of Prospects of CMA

- Cost Auditor, Advising on Cost Records Maintenance

- Special Audit under Customs Act, Central Excise Act, Goods Service Tax Laws.

- Certification under Central Excise, Customs, Goods Service Tax, EXIM Policy

- Consultancy -Tax: Project Management

- Surveyor and Loss Assessor

- Assignments by the Central or State Government, Court of Law

- Labour Tribunals or any other Statutory bodies, Regulatory bodies etc.

- Tax Management (Direct & Indirect Tax)

- Independent Practice – Taxation, Internal Audits.

- Lecturers/Professors in Accounting & Finance

Admission Criteria & Eligibility Requirements

- Equivalent to PG for Admission in Ph.D program

- Eligible to appear in Civil Services Examination IAS,IPS, & other Group A&B Central Services /Posts

Minimum Marks Requirement for Examination

- Minimum 40% marks in each paper & an aggregate of 50% of total marks

Exemption

- INTERMEDIATE?FINAL Students who have achieved a score of sixty percent or more in a paper or papers and have not cleared the group by passing all the appears with 50% aggregate, are exempted from writing that paper/papers for the next subsequent examination.

CMA Foundation

- Paper 1: Fundamentals of Business Law and Business Communication

- Paper 2: Fundamentals of Financial and Cost Accounting

- Paper 3: Fundamentals of Business Mathematics and Statistics

- Paper 4: Fundamentals of Business Economics and Management

CERTIFICATE IN ACCOUNTING TECHNICIAN (CAT)

- Paper 1: Fundamentals of Financial Accounting

- Paper 2: Applied Business & Industrial Laws

- Paper 3: Financial Accounting – 2

- Paper 4: Statutory Compliance

INTERMEDIATE

Group 1

- Paper 5: Business Law and Ethics

- Paper 6: Financial Accounting

- Paper 7: Direct and Indirect Taxation

- Paper 8: Cost Accounting

Group 2

- Paper 9: Operations Management & Strategic Management

- Paper 10: Corporate Accounting & Auditing

- Paper 11: Financial Management & Business Data Analytics

- Paper 12: Management Accounting

FINAL

Group 3

- Paper 13: Corporate and Economic Laws

- Paper 14: Strategic Finance Management

- Paper 15: Direct Tax Laws and International Taxation

- Paper 16: Strategic Cost Management

Group 4

- Paper 17: Cost and Management Audit

- Paper 18: Corporate Financial Reporting

- Paper 19: Indirect Tax Laws and Practice

Electives (Any One)

- Paper 20A: Strategic Performance Management & Business Valuation

- Paper 20B: Risk Management in Banking and Insurance

- Paper 20C: Entrepreneurship and Stat up

EQUIVALENT TO POST GRADUATES FOR ADMISSION IN Ph.D PROGRAMME TO APPEAR IN CIVIL SERVICE EXAMINATION LAS,IP’S & other Group A’/ Group B’ Central Services / Posts.

STANDARD OF PASS minimum 40% marks in each paper and an aggregate of 50% of total marks EXEMPTION If a Candidate is unsuccessful in passing a group but secures 60% or more in any paper or papers, he shall be exempted in the paper from appearing in subsequent examination.Salary

| Chief Financial Officer | ₹ 17,95,997 – ₹ 68, 53,512 |

| Cost Accountant | ₹ 1,18,149 – ₹ 8,00,000 |

| Internal Auditor | ₹ 1,50,000 – ₹ 9,87,342 |

| Finance Manager | ₹ 5,63,739 – ₹ 15,34,429 |

| Assistant Finance Manager | ₹ 2,93,433 – ₹ 8,75,857 |