Association of

chartered certified AccountantS (ACCA) - UK

ASSOCIATION OF CHARTERED CERTIFIED ACCOUNTANTS (ACCA) - UK

About ACCA - UK

Exemption Course

click to view

Course Structure

click to view

About ACCA - UK

ACCA – UK (Association of chartered certified Accountants) is the global body for professional accountants and offer business-relevant, first- choice qualifications to people of application, ability and ambition around the world, who seek a rewarding career in accountancy, finance and management.

ACCA supports 2,40,952 members & 5,41,930 students in India + 180 countries, helping them to develop successful careers in accounting & business, with the skills required by employers, ACCA works through a network of 101 offices and centres and more than 7,200 Approved Employers Worldwide, who provide high standard of employee learning and development.

Entry Requirements

-

For +2 passed students can pursue ACCA if they fulfill requirements

-

Minimum 65% marks in Accounts/Maths & English

-

Minimum 50% marks in other subjects

Qualifying Marks

-

50% marks in each paper (No Negative Marking)

Applied Knowledge Exam

-

All Throughout the year

Applied Skills & Strategic Professional Exam

-

March, June, September & December

Applied Knowledge

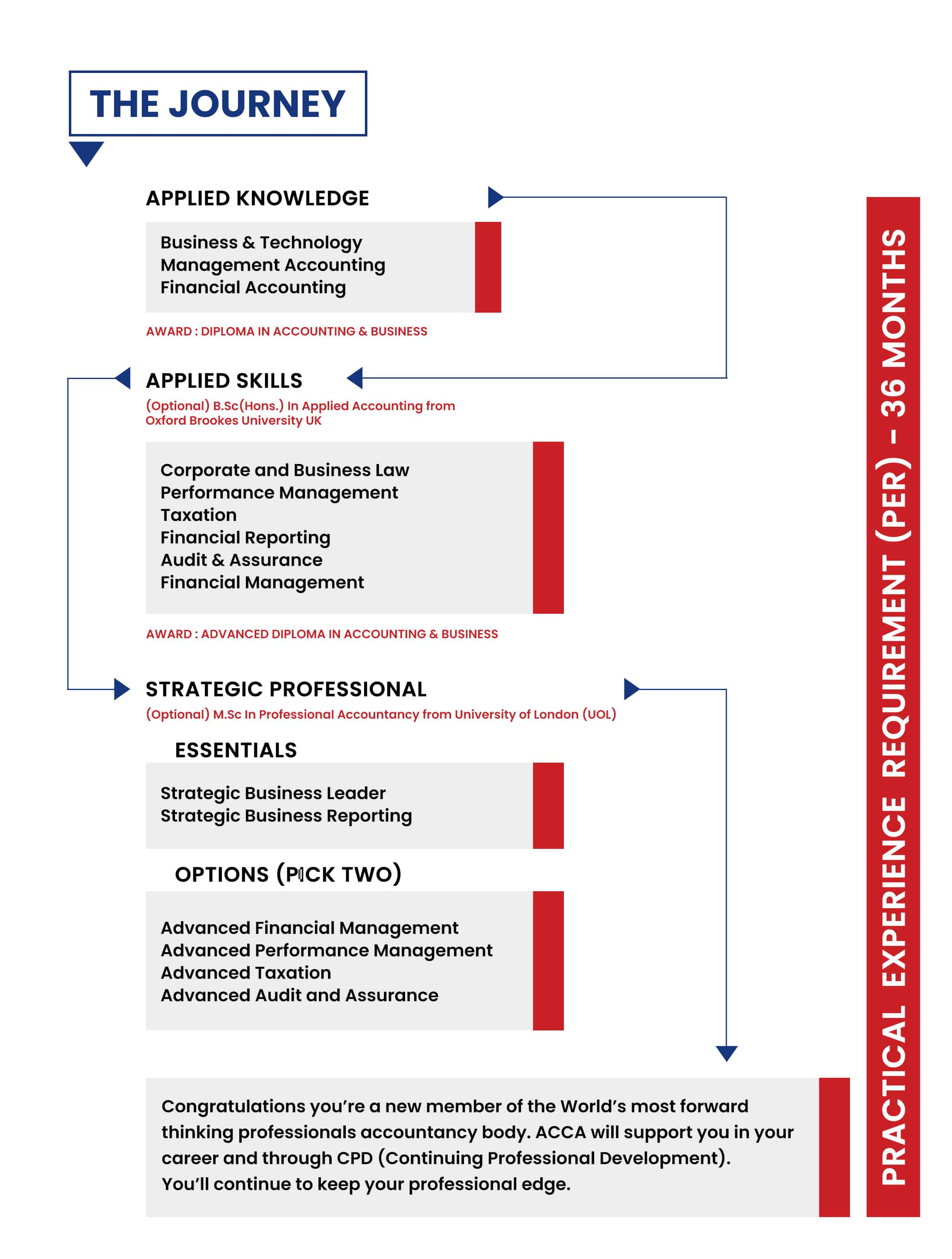

Paper/Examination must be taken in following order Applied Knowledge, Applied skill and Professional order. Within each Module, you can attempt papers in any order.

Salary Details

| Location | Average Salary (Month) (Pound [£]) |

|---|---|

| Australia | £ 33,400 to 40,500 |

| France | £ 23,100 to 31,400 |

| Swindon, Wiltshire | £ 52,500 |

| Germany | £ 23,100 to 28,900 |

| Cambridge, Cambridgeshire | £ 47,500 |

| Hongkong | £ 18,600 to 21,400 |

| Singapore | £ 24,000 to 30,000 |

| Central London | £ 47,500 |

| Switzerland | £ 47,400 to £ 61,000 |

| India – Maharashtra | £ 2,90,874 to £20,34,930 |

| India – New Delhi | Rs. 3,00,000 to Rs. 13,01,210 |

| India – Karnataka | Rs. 2,43,282 to Rs. 8,92,426 |

| India – Chennai | Rs. 1,81,207 to Rs. 9,72,106 |

Exemption Course

click to view

ACCA allows exemptions to the students who have previously studied for relevant accountancy qualification. Exemption means that you will not have to study for and undertake exams of certain ACCA papers. Exemptions offer you the opportunity to start your ACCA qualification from the right level.

You can be allowed exemption depending on your previous accountancy qualification.

The number of exemptions will also depend on your previous qualifications. You can claim up to 9 exemptions. For example if you have passed CAT, you will be allowed exemption from three papers F1, F2, and F3. If you have a law degree, you will be allowed exemption from paper F4. If you have done MBA in Finance, you can be exempted from paper F9. The number of exemption will depend on the course content of your previous qualification.

You can be allowed exemption depending on your previous accountancy qualification.

The number of exemptions will also depend on your previous qualifications. You can claim up to 9 exemptions. For example if you have passed CAT, you will be allowed exemption from three papers F1, F2, and F3. If you have a law degree, you will be allowed exemption from paper F4. If you have done MBA in Finance, you can be exempted from paper F9. The number of exemption will depend on the course content of your previous qualification.

For More Details

Course Structure

click to view

| Subject in Each Levels | Levels | Duration of Course |

|---|---|---|

| BT Business & Technology (F1) MA Management Accounting(F2) FA Financial Accounting(F3) | Applied Knowledge | |

| LW Corporate and Business Law (F4) PM Performance Management (F5) TX Taxation(F6) FR Financial Reporting(F7) AA Audit and Asssurance(F8) FM Financial Management (F9) | Applied Skills | |

| Essentials SBR Strategic Business Reporting SBL Strategic Business Leader Options (Complete any two out of four) AFM Advanced Financial Management APM Advanced Performance Management ATX Advanced Taxation AAA Advanced Audit and Assurance | Strategic Professional |

Enquire us Now

Job Profiles of an ACCA (India +185 countries)

- Audit Senior

- Financial Accountant

- Credit Control Manager

- Purchase to Pay (P2P) Analyst

- Tax Accountant

- Financial Planning & Analysis

- Business Consultant

- Risk Manager

- Compliance/Governance Officer

- Business Analyst

- Forensic Accountant

- Business Partner

- Cost & Credit Control Manager

- Chief Financial Officer (CFO)

- Financial Controller

- Cyber Security Specialist

- ERP Solutions Professional

- Financial Systems Specialist

- IT Audit Specialist

- IT Systems Specialist

- Technology Risk Management (TRM)

- College/University Professionals

- Analyst- Competitive Intelligence

- Business Value Assessment (BVA) Specialist

- Data Scientist (Big Data)

- Business Intelligence Professional

- Fund Manager

- Pricing Specialist Fintech

- Project Accountant

- Treasurer/Consultant

- Risk Analyst

- Banking (Cyber Risk)

- Tax Business Partner

- Record to Report (R2R) Manager

- Compliance/Governance Officer

- Management Accountant

- Non-executive Director

- Regulatory Specialist

- Statutory Reporting Manager

- Purchase to Pay (P2P) Manager

- Business Advisor

- External Audit Manager

- Internal Auditor

- Technology Risk Auditor

- Chief Accountant

- Data Visualisation Specialist

- Fixed Assets Manager

- Group Accountant

SALARY (GBP)

| AUSTRALIA | £ 33, 400 to £ 40, 500 |

| FRANCE | £ 23, 100 to £ 31,400 |

| SWINDON, WILSTHIRE | £ 52,500 |

| GERMANY | £ 23,10 to £ 28, 900 |

| CAMBRIDGE, CAMBRIDGESHIRE | £ 47,500 |

| HONGKONG | £ 18, 600 to£21, 400 |

| SINGAPORE | £ 24, 000 to £ 30, 000 |

| SWITZERLAND | £ 47,400 to £ 61,000 |

| INDIA- MAHARASHTRA | ₹ 2,90,874 to ₹ 20, 34, 930 |

| INDIA- NEW DELHI | ₹ 3,00,000 to ₹ 13, 01, 210 |

| INDIA – KARNATAKA | ₹ 2,43, 282 to ₹ 8,92, 429 |

| INDIA CHENNAI | ₹ 1,81, 207 to ₹ 9, 72, 106 |

The Range of Companies we work with